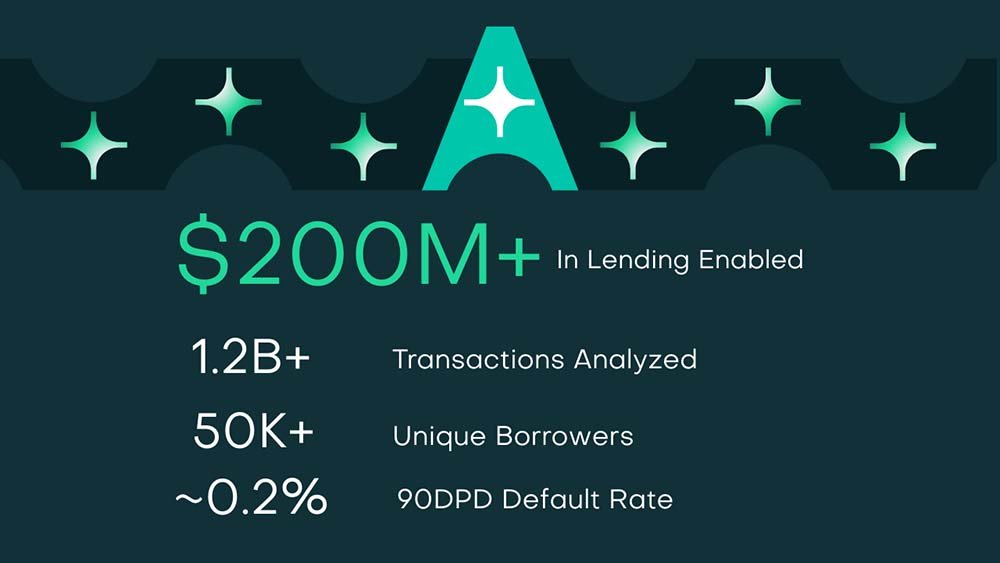

AdalFi, the Pakistan-based fintech platform, has crossed a major milestone by surpassing $200 million in digital lending with a remarkably low default rate of just 0.2 percent. The achievement marks a significant step in the company’s journey as it begins to expand beyond its home market into new international territories. The figures highlight both the scale of AdalFi’s growth and its ability to maintain credit discipline in a sector often challenged by high risk.

AdalFi’s rapid growth in fintech lending

Founded in Pakistan, AdalFi set out with the mission of making access to credit seamless for consumers and small businesses through digital solutions. By integrating directly with banks and using advanced data-driven models, the company provides real-time credit scoring and instant loan disbursement. This approach has helped AdalFi position itself as one of the fastest-growing fintech firms in South Asia.

Crossing the $200 million threshold in lending volume is not only a symbolic achievement but also a sign that Pakistan’s fintech ecosystem is maturing. While digital credit markets in the region are still evolving, AdalFi’s growth demonstrates strong demand for efficient, tech-enabled financial services.

A remarkably low default rate

Perhaps the most striking figure in AdalFi’s announcement is its 0.2 percent default rate, significantly lower than many traditional lending institutions. Default rates in emerging markets are often much higher due to limited financial literacy, weak credit scoring systems, and economic volatility. AdalFi credits its success to the use of artificial intelligence and proprietary credit risk models that allow more accurate lending decisions.

This low level of defaults provides confidence to both partner banks and investors, ensuring that the platform’s lending growth remains sustainable. It also demonstrates that digital-first approaches can outperform traditional banking models in managing risk.

Expanding abroad with fintech innovation

AdalFi’s next chapter involves scaling abroad, with early signs of expansion into other emerging markets where access to credit remains a major barrier to financial inclusion. Markets in Africa, the Middle East, and Southeast Asia are being closely studied for potential entry. By leveraging its technology and success in Pakistan, AdalFi aims to replicate its model in regions facing similar financial challenges.

The company’s international push reflects a growing trend among South Asian fintech startups that are now looking beyond their domestic markets. As digital banking adoption accelerates globally, platforms like AdalFi see an opportunity to serve millions of underbanked customers.

Future outlook for AdalFi

AdalFi’s momentum suggests that its strategy of combining advanced technology with partnerships across the banking sector is paying off. As it scales abroad, the fintech will face challenges such as navigating diverse regulatory frameworks, building trust in new markets, and competing with established global players. However, its strong performance at home provides a solid foundation for international growth.

With more than $200 million in loans disbursed and a default rate of just 0.2 percent, AdalFi is emerging as a case study in how fintech platforms can transform access to credit in developing economies. If it successfully replicates this model overseas, the company could become one of the most influential lending platforms in the global fintech landscape.

Also Read More: BISP camp sites closed – payments will now be collected from shops