The Punjab Government, under the leadership of Chief Minister Maryam Nawaz Sharif, has introduced a groundbreaking initiative called the Asaan Karobar Card. This scheme is a game-changer for small business owners and aspiring entrepreneurs across the province. It provides interest-free loans ranging from Rs. 100,000 to Rs. 1 million, allowing individuals to start or expand their businesses without the burden of traditional bank interest.

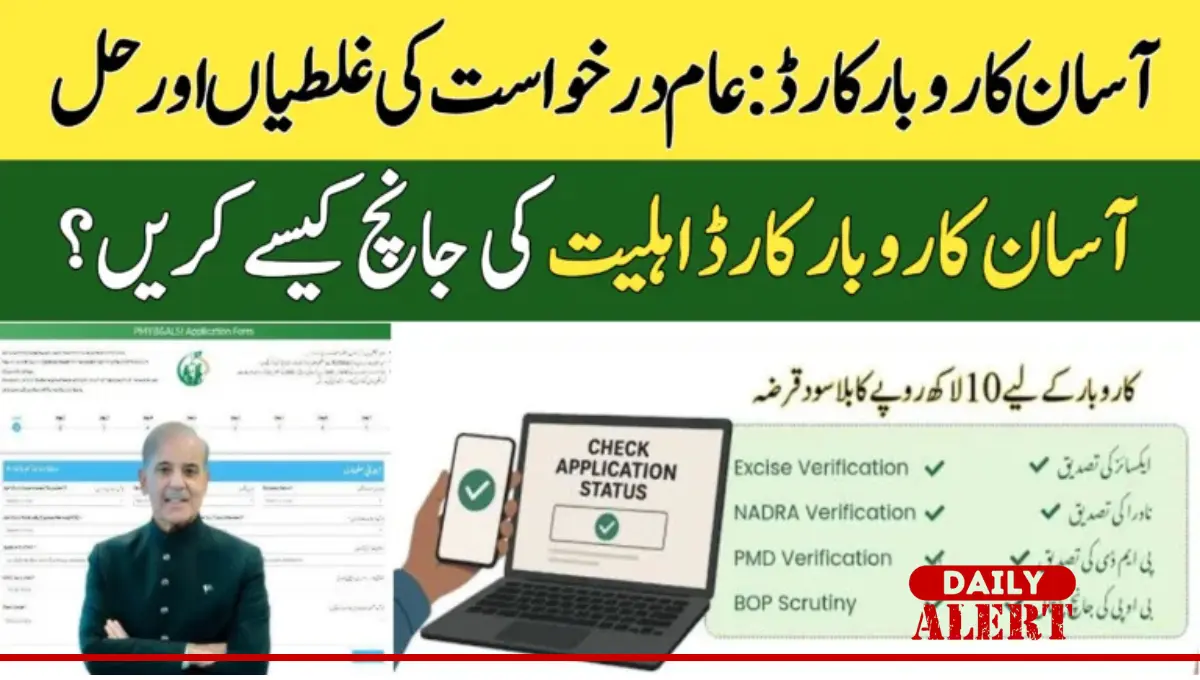

While the initiative is aimed at uplifting the local economy and reducing unemployment, many applicants face challenges related to verification errors, eligibility confusion, and technical issues during the application process. This comprehensive guide will help you understand the Asaan Karobar Card, fix any common errors, and check your eligibility in a clear and practical manner.

Also Read More: Latest Update BISP Payment April Rahim Yar Khan — Full Guide

What is the Asaan Karobar Card?

The Asaan Karobar Card is a flagship financial assistance program launched by the Government of Punjab to promote entrepreneurship and self-employment. The goal is to support individuals—especially the youth—who are either starting new businesses or seeking funds to grow existing ventures. The most appealing feature of this card is that it offers completely interest-free loans that can go up to Rs. 1 million, with a repayment period of up to three years. The initiative is designed to foster financial inclusion and stimulate local business activities throughout the province.

This program is not just about financial support. It is also about creating opportunities. By offering capital to the underprivileged and working class, the government is giving them a real chance to become self-sufficient. The card targets traders, shopkeepers, small-scale manufacturers, freelancers, and women entrepreneurs who often lack access to traditional banking systems. The application process is digital, paperless, and meant to be user-friendly, although applicants must ensure their documents and personal information are accurate to avoid rejection or verification delays.

Eligibility Criteria for Asaan Karobar Card

Before applying, it’s essential to understand whether you meet the eligibility criteria set by the government. These criteria ensure that the scheme benefits those who truly need financial assistance and are capable of utilizing it responsibly.

- Permanent Resident of Punjab: You must have a valid proof of residence within any district of Punjab. Applicants from other provinces are not eligible.

- Age Limit: The applicant must be between 21 and 57 years old. This age range is chosen to include both the youthful workforce and experienced individuals seeking to boost their businesses.

- Valid CNIC: A valid Computerized National Identity Card (CNIC) issued by NADRA is compulsory. Your application details must match the CNIC exactly.

- Mobile Number Registered on CNIC: Your contact number must be registered against your own CNIC. Numbers registered under someone else’s name can cause verification failures.

- Business Intent or Plan: Although not strictly required, having a clear idea or plan for your business significantly increases your chances of approval.

Meeting these criteria ensures that your application will move forward without unnecessary delays during the screening and verification phases.

Step-by-Step Guide to Apply for the Asaan Karobar Card

The government has developed a user-friendly online portal for applying to this scheme. Here’s a detailed step-by-step process you can follow:

- Visit the Official Website: Open https://akc.punjab.gov.pk in your browser. This is the official portal for the Asaan Karobar Card application.

- Create an Account: Click on “Register” to create an account. Enter your CNIC number, mobile number, and create a password.

- Login and Fill the Form: After registering, log in to your account and start filling the application form. You will be asked to provide personal details, business information, and financial background.

- Submit the Form: Once all information is filled in and reviewed, submit the form. You will receive a confirmation message if the submission is successful.

- Wait for Verification: Your application will be forwarded to NADRA, Excise & Taxation Department, and the Bank of Punjab for multi-layered verification.

- Track Application Status: You can log in anytime to check the status of your application, whether it’s under process, verified, or if there are any issues.

Make sure to double-check every detail before submitting. Even a small typo in your CNIC or mobile number can lead to rejection or delay.

How to Check the Application Status Online

Once you’ve submitted your application, it’s important to keep track of its progress. The online portal allows you to view your application status anytime. Here’s how you can do it:

- Login to the Portal: Go to the official website and log in using your CNIC and password.

- Navigate to Saved Applications: Under the user dashboard, click on “Saved Applications” or “Application Status.”

- View Status: You’ll see your submitted application and its current status, such as “Under Verification,” “Verified,” “Rejected,” or “Error.”

- If your application . In such cases, read on to find out how to fix common errors.

Also Read More: 8123 Web Portal Latest Update – Check Status with CNIC in Minutes

Common Verification Errors and How to Fix Them

Several applicants have faced issues due to mismatched records or outdated documentation. Here are the most common errors and practical steps to resolve them.

1. Excise Verification Error

This issue arises if you have vehicle-related dues or outdated ownership details in the Excise Department’s database. To fix this, visit the Excise & Taxation Department website at https://excise.punjab.gov.pk to check for pending dues. Clear all pending challans or fees. Then contact the helpline at 1786 and inform them once your dues are cleared.

2. NADRA Verification Error

If your CNIC has expired or if the application details don’t exactly match your NADRA records, your application will be blocked. Visit your nearest NADRA office and renew your CNIC. Ensure your name, date of birth, and father’s name match exactly with what you entered in the application. Re-login and edit your form if the option is available.

3. PMD Verification Error (Mobile Number Mismatch)

If the mobile number you provided is not registered on your CNIC, verification will fail. To fix this, visit your mobile network service center and re-register your number under your own CNIC. If the form is still editable, correct your number. Otherwise, contact 1786 for manual updates.

4. Bank of Punjab (BOP) Error

Errors at the bank level usually relate to your financial history or system delays. If you receive this error, wait at least 72 hours as banks take time to verify applications. If the error persists, call the Bank of Punjab at 111-267-200 or AKC helpline at 1786.

Can I Edit or Reapply?

Yes. If your application was rejected or returned due to an error, you can edit your form if the system allows it. Simply log in to the portal and check for an “Edit Application” option. If that is not available, call the helpline and ask for guidance on resubmission or corrections.

In some cases, you might have to wait for a few days before the edit option becomes available, especially after verification failure. If rejected due to verification, you may reapply after resolving the issue.

Helpline and Contact Information

For any kind of technical support, verification problems, or application corrections, you can reach out to the following:

- Asaan Karobar Card Helpline: 1786 (Toll-Free, Active during working hours)

- Bank of Punjab (BOP): 111-267-200

- Make sure to keep your CNIC and application reference number handy when calling.

Also Read More: BISP 8171 Online Check – Latest Payment Status for April 2025

Final Thoughts

The Asaan Karobar Card is a powerful initiative by the Punjab Government that can transform the lives of many aspiring entrepreneurs and small business owners. It offers a real chance to access interest-free funding, which is a rare opportunity in today’s financial environment. However, successful participation in the scheme depends on providing accurate information and staying proactive during the application and verification process.

By following this detailed guide, you can avoid common errors, fix any issues in your application, and increase your chances of receiving the loan successfully. Remember, financial independence starts with small steps—and this card might be the one that helps you take the leap.

Frequently Asked Questions (FAQs)

Q1: What is the age limit for the Asaan Karobar Card application?

Applicants must be between 21 and 57 years old at the time of applying.

Q2: What should I do if my application status shows “PSID: null”?

This means your application faced verification issues. Review and correct your form if editable or contact helpline 1786.

Q3: Can I reapply if my application is rejected?

Yes, but only after fixing the issues that led to the rejection. You may need to wait before resubmitting.

Q4: Is it mandatory to have a business idea before applying?

While not officially required, having a clear business plan improves your chances of getting approved.

Q5: What kind of businesses are eligible for this scheme?

The scheme is open to small retailers, shopkeepers, service providers, freelancers, and micro-enterprises in Punjab.

Also Read More: Benazir Taleemi Wazaif Stipend Payment Increase Announced for Students

Yeh Asaan Karobar Card initiative sach mein small business walon ke liye ek golden chance hai. Mujhe bhi “PSID null” ka error aaya tha lekin yahan se guide follow karke easily fix kar liya. 100% interest-free loan ka concept bohat acha hai, bas thoda application process aur smooth hona chahiye. Shukriya CM Punjab aur team!

More Information: https://ehsaaswebportal.pk/